Medicare Advantage plans are in a Darwinian race to survive. For every star ratings winner, there’s also a loser because the pool of Quality Bonus Payments (QBPs) is fixed. Standing still isn’t an option.

And the financial implications of star ratings are massive. Dropping below 4 stars could lose plans $500 per member per year in QBPs. Gaining a star can mean an additional $10m. And as patients are increasingly choosing plans based on their star ratings, gaining an additional star also means new members.

Clearly, maintaining or improving your star ratings is critical to your plan’s future. But gaining a star – and even just avoiding losing a star – is becoming harder each year. Plans have improved significantly by many measures and many of the easy wins are already gained.

So is there something you can do to significantly influence your star ratings that you’re not already doing? We think so, and it’s all about member experience.

Why member experience matters more than ever

Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey measures were already double-weighted in the contract year 2020. They’re now quadruple-weighted, making up 32 percent of the entire star rating. This means access to care and member experience are now just as important as outcomes measures.

In other words, targeting member experience has become a key intervention. A recent McKinsey report makes the point:

‘Many insurers will also need to increase their focus on patient-experience and access measures… Concerted efforts to improve in this area could enable insurers to outperform competitors.’

How can you enhance member experience? Several scores are, unsurprisingly, related to the experience of the care itself – rating of health care quality, getting appointments quickly, or care coordination, for example. None of these are easy for health plans to influence.

But what you can influence is overall satisfaction with the health plan: your members’ perception of how good it is.

Understanding is critical to satisfaction

If members find their health plan confusing, opaque, or simply too complex, they will not be satisfied with it. Far from it. They will struggle to know what they can claim for and how. When they contact you looking for clarification, they will cost you money by driving up your contact center caseload. And as members, they will be suspicious and unhappy.

This kind of confusion also has an impact on outcomes and drug adherence. But let’s focus on the customer experience here.

We know that members typically don’t understand communications from their health insurers. Accenture reported that 52% of consumers struggle to navigate the health insurance system. And our own research found that two-thirds of health insurers produced content that was more difficult to read than Moby Dick.

We know that this is a significant problem – which means that fixing it will have an equally significant impact.

Can changing language make a real difference?

A recent customer of ours improved their direct communications with members. For them ‘case reopens’ was an important metric, and they achieved a 60% reduction in case reopens simply by changing their use of language and using our Language Analysis Platform to identify overly complex content in their letters and communications.

Key aspects to communication quality

Central to the member’s experience are several aspects of the information they receive from their plan. Each of these is measured in CAHPS surveys, in numerous questions and contexts.

- How easy is it to understand?

- How confusing is the information?

- Is there too much information?

Each of these can be tackled in specific and measurable ways.

1. Make your communications easier to understand

Ease of understanding is fundamentally driven by how simply something is written. Simplicity here essentially means how much cognitive load or mental overhead you’re imposing on your readers. Our brains have limited working memory to process information. Complicated language places extra demands on working memory and makes information harder to digest. To avoid heavy cognitive load:

- Avoid long sentences and paragraphs

- Use the active voice to communicate who is doing what

- Use simpler language where possible eg: ‘use’ vs. ‘utilize’

- Move logically from one point to the next

2. Make your communications less confusing, avoid ‘insider speak’

Here the emphasis is less on the simplicity of syntactic structure and more on tackling confusing concepts that your reader may not understand.

- Avoid insurance jargon like ‘deductible’ or ‘co-pay’ – these may be utterly familiar to you, but they’re not to members. If you can’t avoid the terms, then clearly explain them.

- Avoid medical jargon – even something as simple as ‘positive diagnosis’ will confuse people, and terms such as ‘cardiovascular disease’ should be replaced with everyday language like ‘heart disease’.

- Limit your use of acronyms – even when they’ve been explained members may struggle to remember their meaning.

3. Make sure your communications don’t contain unnecessary information

Communicating effectively isn’t simply about using language well, it’s also about what you choose to say and what you decide isn’t needed. Studies show that too much information reduces the overall information retained by the reader – not just as a proportion but in real terms.

- Only say what is necessary

- Discard ‘nice to have’ information

- Be ruthless! Put your copy on a diet

- Apply this both to the entire communication but also to each sentence and paragraph

4. Be consistent about it

There is little point in improving communication quality in 30% of the language you use with your members. People remember the bad stuff – the times they got so confused they gave up, the sinking feeling they felt after receiving a letter that worried them but they couldn’t understand. The secret to improving perceptions is to be consistently better – in both clarity and in the voice you use to speak to members.

Addressing these aspects of language will dramatically affect your members’ understanding and hence their satisfaction ratings.

5. Tackle communication quality at scale

If you want to make a real difference to member perceptions, you must apply these ideas across all your member touchpoints – plan explanations, factsheets, claim letters, referral letters, and so on.

The only way to do this efficiently is to use a software platform designed for the purpose.

You need to equip your writers with a tool like VT Writer to help them write more clearly. And you need to measure clarity and consistency across all your teams and writers with dashboard reports found in a reporting component like VT Insights.

You can then support these three goals.

1. Easier to understand

- Set rules for sentence length, eg a maximum of 20 words

- Set rules for specific complex language to avoid, eg don’t use ‘cardiovascular disease’, instead use ‘heart disease’

- Highlight instances of the passive voice

- Show readability scores for all paragraphs eg flag paragraphs with a high readability grade level, meaning content is inaccessible and dense in tone

- All this will help you filter out unnecessary information as well as making the information you keep easier to understand

2. Less confusing

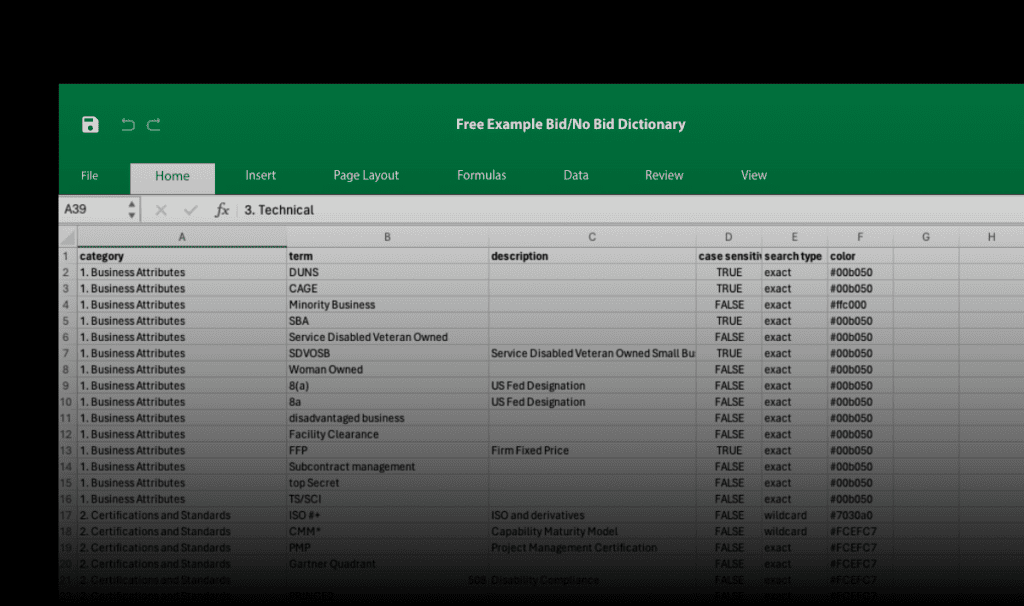

- Create a list of insurance and medical jargon and technical terms, as well as acronyms

- Set these terms and acronyms up as ‘Watch Words’ in your writing software

- Whenever writers use these words they’ll be alerted and promoted to use a simpler alternative

3. Ensure a consistent voice across all teams and writers

- Run reports that compare different team’s content

- Flag improvement across writers and teams

- Reward best performers

- Help non-performers to write better through in-app guidance

- Use refresher sessions to evangelize the benefits of accessible language for teams

Achieve measurable improvements

Using language analysis platforms like VisibleThread, you can ensure your writers focus on member understanding and satisfaction. They will be prompted when they write overly complex or inconsistent content. And this will change their writing habits.

Meanwhile, you’ll be able to measure consistency and track progress across your entire suite of member communications – and target areas that are failing to meet minimum readability standards.

If your communications consistently improve, your members will find it easier to understand their plan benefits. They will be more likely to act when prompted to, and less likely to open cases with your contact center. And because they’re less confused, they will feel greater satisfaction. In short, they’ll be happier customers, and score you better.

Improving member experience is a shortcut to a better star rating under your control. And that’s worth its weight in gold. Are you ready to take action?