- Services

- Fees

- Conflicts of interest

This presents huge challenges for financial services organizations. And that’s not even the whole story. You must write Form CRS in a maximum of either two pages (or four for firms offering brokerage and advisory services). And, in plain English. Those all-important three words.

As experts in plain language, we’re here to help you figure out what this new world looks like. Looking for general advice on your entire Reg BI obligations? Hold on for some relevant links towards the end of this blog.

So what are the SEC’s plain language requirements?

The SEC has offered some specific advice as part of the ruling. We can also refer to their Plain Language Handbook, published in 1998 but still relevant as ever. For starters, the SEC wants you to:

Use short sentences

Why should we do this?

A longer sentence is harder to understand than a short one. Or, simply explained by the UK Government:

“When you write more, people understand less”.

A long string of words is difficult to comprehend. You’re unlikely to retain the writer’s thoughts from beginning to end. And this gets even more tricky when the subject matter is unfamiliar to you. Financial disclosures are a great example here – very few investors understand everything there is to know about investments. As the SEC points out:

“Because many investors are neither lawyers, accountants, nor investment bankers, we need to start writing disclosure documents in a language investors can understand: plain English.”

Cognitive load theory also comes into play here. Our brains have limited working memory to process information, so using long sentences makes content harder to digest. If the investor is multi-tasking when he reads your disclosure, it’s likely that he will miss important messages.

How can we do this?

Try using one thought for each sentence. And, instead of listing items, use bullet points. We’ve got lots more tips on how to avoid using long sentences in this blog.

Use everyday words

The SEC rule states that advisers should avoid technical jargon. Unfortunately, there’s plenty of this within the financial industry.

Why should we do this?

As we’ve established, very few investors are experts in investments. By using complex words and industry jargon, you’re adding barriers to understanding. Opt for everyday words so readers grasp your meaning the first time round. And by the way, there might not be a second time. This is the age of the empowered consumer. Your customer won’t think twice about leaving you for a competitor who creates disclosures she understands.

How can we do this?

Know your audience. Imagine a typical investor, and write for that person. How familiar is she with financial disclosures? Or investments? Or financial terminology? Create your content with a “layman” in mind.

Warren Buffett wrote the preface to the SEC’s handbook. He offers similar advice:

“I pretend that I’m talking to my sisters… Though highly intelligent, they are not experts in accounting or finance. They will understand plain English, but jargon may puzzle them”.

And that’s a great point. Just because your audience is smart, doesn’t make them an expert in your industry. If you err on the side of simplicity rather than complexity, you will engage more people. And if you really have to use jargon or acronyms, then be sure to explain or define them.

Use active voice

Why should we do this?

This is another case of clarity vs complexity. By using active voice, you’re making it clear who is doing what. Take this example from the handbook:

The proxies solicited hereby for the Heartland Meeting may be revoked

And compare it with:

You may revoke your proxy

The first sentence contains passive voice so it’s not clear who can revoke the proxies. The second sentence is in active voice: “You may revoke your proxy”. There’s no room for misinterpretation. Although, I’d vote for changing out “revoke” and “proxy” for some more “everyday” words!

How can we do this?

In order to reduce your use of the passive voice, you first need to identify it. In an active sentence, the person or agency that’s “doing the doing” is the subject of the sentence. In a passive sentence, the person or item that’s “done to” is the subject of the sentence. You need to find any hidden verbs and make them active. We’ve got plenty of advice on avoiding passive voice in this blog.

Avoid negative expressions

Why should we do this?

Positive sentences are shorter and easier to understand than negative ones. Take the following example from the handbook:

Negative:

Persons other than the primary beneficiary may not receive these dividends.

Positive:

Only the primary beneficiary may receive these dividends.

The negative element in the first sentence adds an extra level of complexity. The positive language in the second is much clearer.

How can we do this?

Seek out negative language in your disclosures. Look for phrases such as “does not include” or “not unlike” (see more examples on p.27 of the handbook). Once you’ve found them, make them positive.

Where can I find more help?

It might take time to implement plain language concepts across your business. Especially if you’re not already familiar with them. For extra support, check out:

The US Government’s Plain Language website

The Plain Language Act came into force in 2010, and this site offers useful guidance to help businesses comply. Their checklist is a good place to start.

Readability solutions

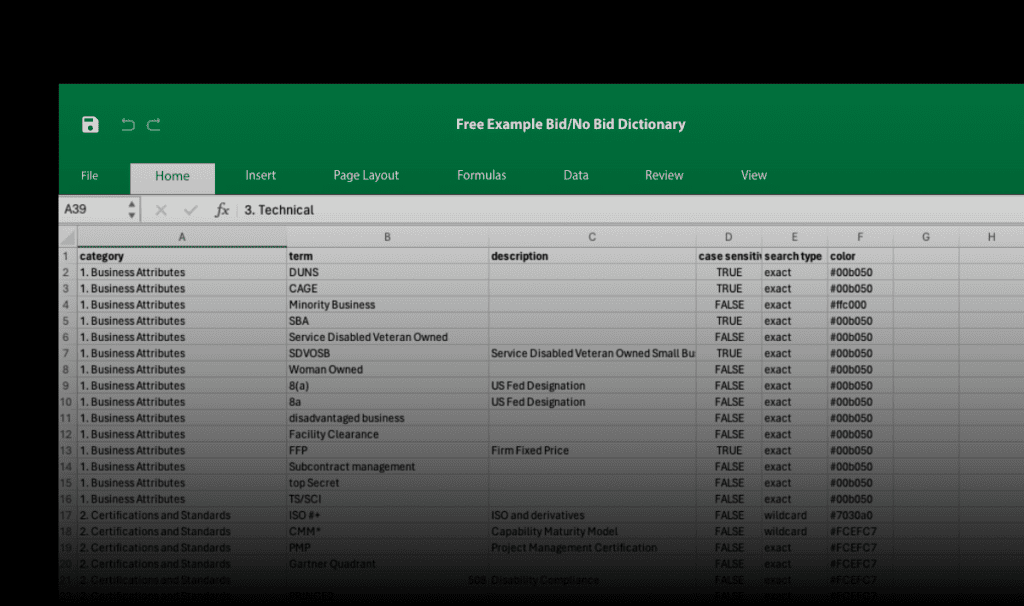

Our own VT Writer solution scans and scores documents for indicators of readability such as:

- Long sentences

- Complex words

- Passive voice

Non-writers, like financial brokers, get help with writing disclosures in plain English. You can even add a ‘Watch Word’ list of negative terms to ensure negative phrases are highlighted. And with VT Insights, organizations can manage this across their organizations, as well as track progress over time.

This is only the beginning…

As we mentioned in our introduction, plain language is just one aspect of part of Reg BI. Brokers and advisers must familiarize themselves with all the new regulations. You can check out the SEC’s own Compliance Guide and FAQs for more guidance.

It’s clear that there’s a lot of work to do here. Don’t underestimate the time and effort it will take to get to grips with these plain language principles. Not to mention rolling them out across your whole organization. But, in the words of the SEC, there are many benefits beyond legal compliance:

“The benefits of plain English abound. Investors will be more likely to understand what they are buying and to make informed judgments about whether they should hold or sell their investments. Brokers and investment advisers can make better recommendations to their clients if they can read and understand these documents quickly and easily. Companies that communicate successfully with their investors form stronger relationships with them. These companies save the costs of explaining legalese and dealing with confused and sometimes angry investors.”

It’s time to embrace plain language.