Why is healthcare so emotional?

We’re talking about the life and death of members and their loved ones. Of course, it’s emotional. Jack explains that if something goes wrong, or is communicated badly, the following kicks in:

- Confusion

- Fear

- Lack of confidence in the service

The result is panicked members who reach for the phones to call their provider. And increased call center volume is as bad for business as it is for members.

Unfortunately, Jack has observed that most healthcare insurers are “tone deaf” when it comes to communicating with empathy.

Where is the industry going wrong?

It all starts with member communications. Very often, Jack has observed that there is a lack of clarity in the content going out to members. As well as an overuse of medical jargon, long sentences, and passive voice. This results in poor member experience Our own research, specifically into Medicare communications, turned up the same results. We found that:

- 86.6% of Medicare documents are not accessible to their target audience, those aged 65+.

- 2/3 of insurers produce content more difficult to read than Moby Dick.

- 56.6% of insurance companies communicate in an academic tone with overuse of passive voice.

- Trust in the health insurance industry is declining year on year.

When we shared these poor results with Jack, he wasn’t at all surprised. In fact, he had expected the percentage of inaccessible Medicare documents to be higher. Having spent decades working in the industry, he’s seen time and time again how companies fail their members.

Clear, compassionate communications for all

We’ve discussed the older, more vulnerable generation. But what about everyone else? Jack argues that there’s actually a big problem with how the healthcare industry treats all its members. Everyone needs clear communications about their healthcare. Whether that’s a business person educated to degree level or a lawyer with a doctorate. We’ve discussed many times the fallacy of the sophisticated customer. Members might be well-educated, but will they understand complex health concepts and jargon? Not necessarily. Also, they are busy, their cognitive load is high. In Jack’s words:

“I’m not implying that we should dumb things down for people. I’m implying that we should write things with the audience in mind.”

And what about the argument that healthcare is a complex topic, so communications will always need to be complex? “That’s a sell-out”, according to Jack.

Steps to success

So why is this happening? And what approach does Jack suggest?

1. Get it right first time

Very few companies deliberately set out to create complex content. It happens regularly within the healthcare industry because of internal dynamics. Jack gave us the example of a claims team, who are usually the teams creating claims letters. Despite being totally unqualified for this role. He argues that, if we are to solve these issues, we need to focus on processes and quality.

“Do it right the first time, and cut down on re-works.”

It’s simple. Create claims letters (as an example) with the audience in mind. Avoid a spike in calls when they hit the mailbox.

2. Better staff training

As part of Jack’s experience with Part D, his team were regularly sending out 500,000 – 1 million-member letters.

“We had over two million members so we had an extraordinary amount of letters hitting the mailbox at the same time. And if those letters were not written right, those members called in and killed our call center. So we went through extensive letter writing analysis to help us improve our communications.”

Look at the processes of sending out communications, and make necessary improvements. A short-term investment in analysis and training in call center efficiency can very often lead to savings downstream.

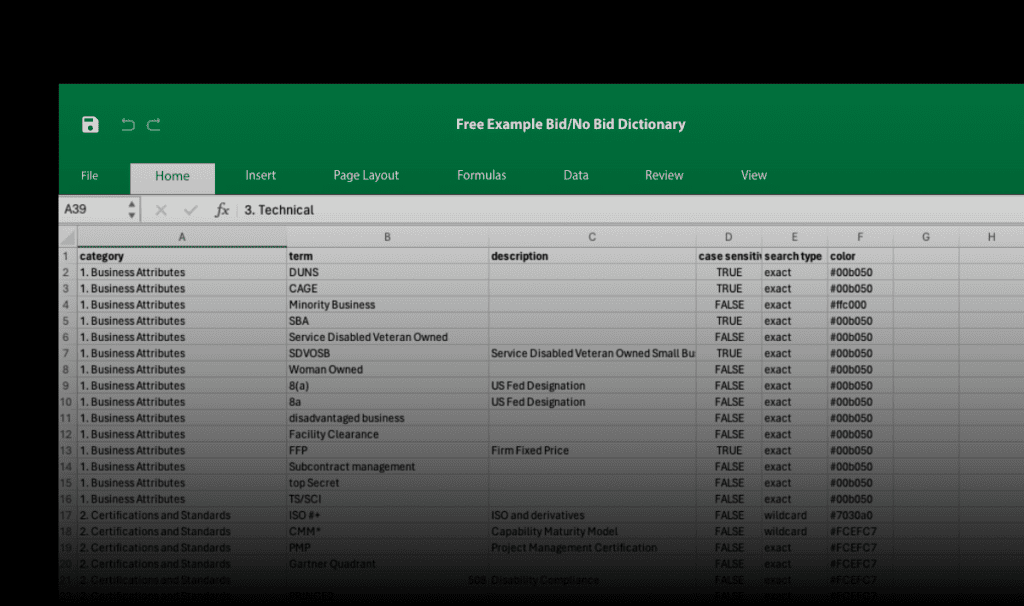

3. Consider readability solutions

Another helpful resource comes in the form of readability software, such as VT Insights Platform. The solution flags:

- Jargon

- The use of long sentences

- Overuse of the passive voice

- Grade level

Whether the claims or marketing team are creating content, VT Insights Platform allows all employees to easily score their own writing. And using VT Insights, management can ensure all member content achieves a minimum standard of readability.

What excellent member experience really looks like

Jack told us that customer experience is a bit of a buzz term in healthcare insurance right now. It’s appearing in presentations to the board, but he wonders how often it actually reaches the call center floor. Let’s say a representative is tasked with keeping talk time under four minutes. How much compassion can she really offer the caller in that short time? Many providers make the mistake of implementing goals that directly contradict an empathetic approach.

An organization that really cares about its members will approach things differently. In a few of his roles, Jack was part of regular member/customer focus groups.

“We’d bring in 20 seniors for lunch. We’d eat pizza, and talk about the things they would want to see from their health carrier.”

Connecting with members is so important. There’s a real ignorance from the industry in understanding how the other side views healthcare. There is a massive opportunity for insurers to consider the member/customer journey, and consider their possible state of mind at each stage. Some of the many benefits on offer include increased member retention. Improve call center efficiency and lower the volume of calls. Satisfied staff and members, and higher customer acquisition. It really pays to be thoughtful.